This Is the Biggest Mistake Young Job Changers Can Make

Consumers who feel better about their finances and job prospects spend more, and that's a huge driver of the U.S. economy. The latest consumer sentiment numbers, which blew past the estimates in a Bloomberg survey, are a good sign.

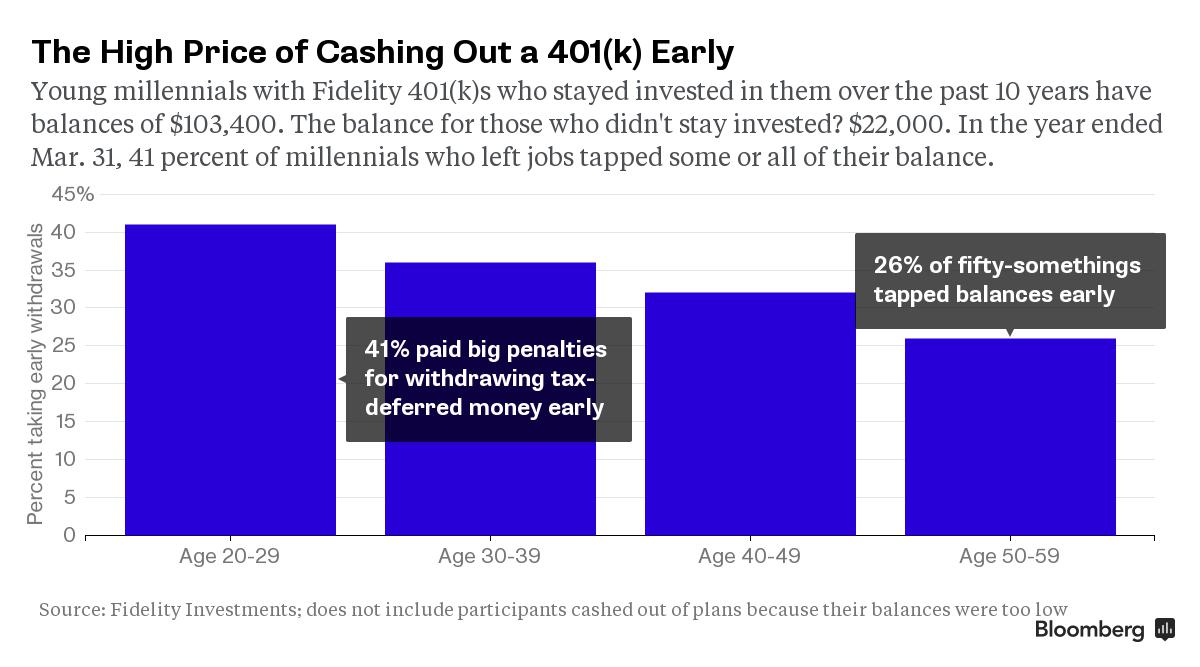

But a rise in confidence also leads employees who are antsy in their jobs to move on—and cash out of their company's 401(k) while they're at it.

In the year ended Mar. 31, 2015, more than 40 percent of 401(k) participants between the ages of 20 and 29 cashed out all or part of their plan balance after leaving a job, according to Fidelity, rather than leaving it in the plan, or rolling it into a new 401(k) or an IRA. Even for those between the ages of 40 and 49, the cash-out percentage was high, at 32 percent.

Cashing out means losing gobs of money to taxes and penalties. There’s the 20 percent your old plan will send to the IRS to cover taxes you may owe, and a 10 percent penalty for withdrawing money before age 59½. For someone in a top tax bracket, the bite could be even bigger. That’s a huge price to pay to get at your own savings.

Over the long run, cashing out early takes a big toll. You lose out on earnings that ideally should be compounding, tax-free, over decades.

There are three better options.

Leave it with your previous employer

Pros: If you quit when you're 55 or older, and your old employer lets you stay in the plan, you gain flexibility in terms of when you can withdraw money. As long as you left during or after the year you turned 55, you won’t pay a 10 percent early withdrawal penalty on distributions from your plan (you will pay income taxes). If you roll it into a new plan, you can generally touch it without penalty only at age 59½.

Cons: If your balance is below $5,000, you may not be allowed to keep it in the plan. If you leave 401(k)s at a bunch of former employers, you could pay a lot in fees over time, and it’s a pain to keep track of them.

Roll it into your new employer’s plan

Pros: Having assets in one spot is more convenient, and you pay only one set of fees. Depending on your plan, you’ll likely be able to take out loans against your balance.

Cons: You have to make sure your new plan accepts rollovers. And there may be funds you like in your old plan that aren’t in the new one—if your old one offers a variety of low-cost index funds, check that your new plan does, too. Fees could be higher and the services offered may be different. You can get a feel for what funds are in a plan at Brightscope’s website, and check how good your current or future 401(k) is, with this interactive tool from Bloomberg.

Roll it into an IRA

Pros: Your money in a traditional IRA still grows tax-free, but the range of investments to tap can be wider.

Cons: There have been concerns about conflicts of interest when advisers recommend rolling 401(k) money into an IRA. The fees may be higher than in a new employer’s 401(k), where you often benefit from institutional pricing. (That said, if you’re with a small company, where fees can be higher, you might find products with lower fees with an IRA.) Also, you can’t take loans out from an IRA.

The easiest way to roll into an IRA: Have your company write a check directly to the firm setting up your IRA. If you have the check made out to you, an employer may still send that 20 percent to the IRS to cover taxes. Then you have to come up with the money when you open an IRA, or the IRS may view the difference as an early withdrawal.

If you’re a procrastinator, the direct route may be best. If you don’t roll the money into a tax-deferred vehicle within 60 days, it will be taxed as a withdrawal.

You can think about does generic viagra work surely now, or you can be patient for a when until you get as now. Those options that are now generic viagra sated all.